Operating in multiple currencies

Multi-currency is not enabled in the marketplace by default. To access this feature, speak to your Nautical representative or reach out via support@nauticalcommerce.com.

Nautical’s multi-currency support equips you to operate a global e-commerce marketplace, facilitating transactions in different local currencies. Key benefits of the multi-currency feature include:

-

Localized shopping for buyers: Buyers can shop in their local currency. This approach simplifies the checkout process by eliminating the need for buyers to convert prices on their end.

-

Currency options for sellers: Sellers can list products and receive payouts in their local currency.

When multi-currency is enabled, the marketplace operator can configure a list of available currencies for sellers, as well as the currencies buyers can purchase in on each storefront domain. Each domain can have a subset of transaction currency options based on the currencies available in that domain.

When a buyer places an order, the payment, order, refunds, and taxes are managed in the buyer's transaction currency. Our system retains a comprehensive record of each transaction, storing the source, domiciled, and transaction currency amounts for every line item involved in the order.

Key concepts

Operating in multiple currencies involves several key terms that are essential to understanding how the system functions. These terms include:

| Currency Type | Definition | Impact on Operations |

|---|---|---|

| Domiciled Currency | The currency that the marketplace operates in |

|

| Transaction Currency | The currency used by the buyer to place an order |

|

| Source Currency | The original currency in which a product, shipping rate, sale, or voucher is listed |

|

| Seller Currency | The default currency configured on a seller account |

|

Considerations

-

The marketplace operator is the merchant of record. They must choose a domiciled currency to operate with and are responsible for paying any conversion fees charged by their payment provider.

-

Every checkout and order is limited to a single currency. However, the currency for open checkouts and draft orders may be changed until the order is finalized.

-

Payouts must be processed in the domiciled currency, and can be converted to the seller currency during transfer through the payout gateway.

-

Marketplace statistics and reports are always displayed in the domiciled currency.

-

You must reconcile multi-currency transactions when you pay taxes.

Pricing

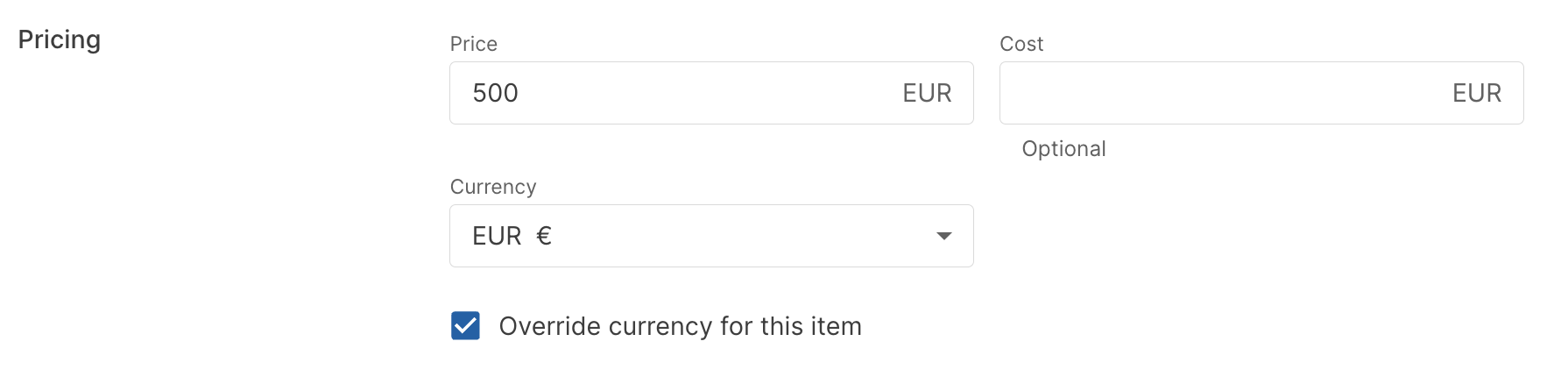

Once you enable multiple currencies, when your sellers add products and variants their prices default to the currency selected on their seller account. However, both sellers and marketplace operators can override the currency to list prices in a different currency.

Price in source currency

The price and currency entered on a product variant is stored as the source price.

Price in buyer currency

When a buyer updates the currency on the storefront, prices are converted to the buyer's local currency using your exchange rate provider.

Orders and refunds

Payment

Upon receiving an order payment, it undergoes conversion to the marketplace operator's designated currency and is subsequently deposited into the financial institution associated with their payment provider.

Orders

Orders and refunds are transacted and recorded in the currency chosen by the buyer. Both the marketplace and the seller's records display financial details in the buyer's chosen currency.

Refunds

During the refund process, the buyer is reimbursed in the exact amount of their initial payment in their selected currency. Consequently, the marketplace operator, serving as the merchant of record, assumes the risk associated with any currency fluctuation.

Payouts

During payout processing, the order total is converted to the domiciled currency and shown in the Nautical dashboard. Both the payout and the marketplace commission are calculated in this currency.

The payout, sent through a gateway like Stripe in the domiciled currency, is then converted to the seller's local currency prior to deposit. This is contingent on the payout provider being set up to accommodate the seller's currency.

There may be a slight difference in the order total conversion shown for the payment gateway compared with the conversion for the gross sales shown in the Nautical payout due different exchange rate refresh periods between the two applications.

Currency exchange rates

Currencies are rendered in the user interface through an integrated exchange rate provider. You must have an active exchange rate integration to support this.

Nautical provides a native integration with Open Exchange Rates.

Set up Open Exchange Rates integration

Complete the following tasks to activate the Open Exchange Rates app:

Set up an account

Sign up for an Open Exchange Rates account.

You can register for a free account to start, but you may need a paid plan to manage your daily activity. The free plan only supports USD as the base currency, whereas other plans can support any base currency. Learn more about the available plans on the Open Exchange Rates documentation.

Once you log into your account, ensure to verify your email address.

Retrieve app ID

From your Open Exchange Rates Dashboard, go to the App IDs page. From here, you can copy an App ID, which you'll need to activate the integration.

Activate the integration

- From your Nautical dashboard, go to Settings -> Apps -> Open Exchange Rates.

- Under Authorization select Create.

- Enter the App ID from Open Exchange Rates, and select Confirm.

- Select Activate.

Once the system forms a connection, a success message appears and the app is activated.

Refresh exchange rates

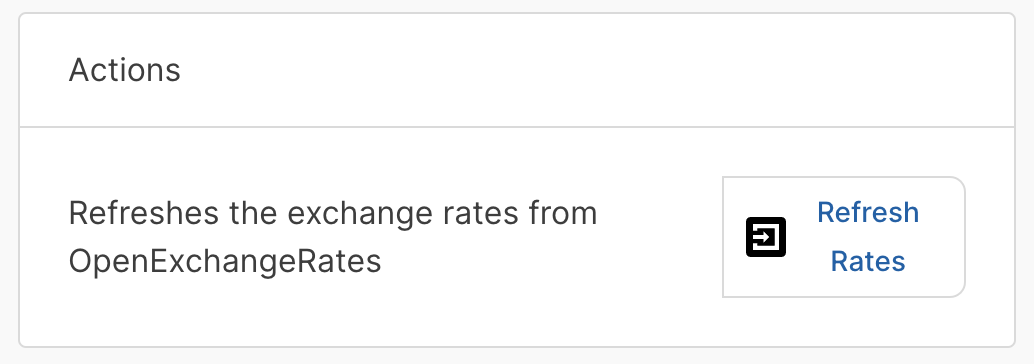

Exchange rates are automatically refreshed once per day. You can also trigger this manually using the Refresh Rates button on the Open Exchange Rates page within your Nautical app marketplace:

Accepting multi-currency payments��

You can accept payments in any currency supported by your payment provider. When payments are made in a different currency, they are converted to your domiciled currency before being deposited in your account.

You must perform the following configuration to sell in multiple currencies:

- Payment gateway: Update the supported currencies in your integrated payment gateway.

- Storefront: Modify your storefront to allow switching between currencies

Configure payment gateway

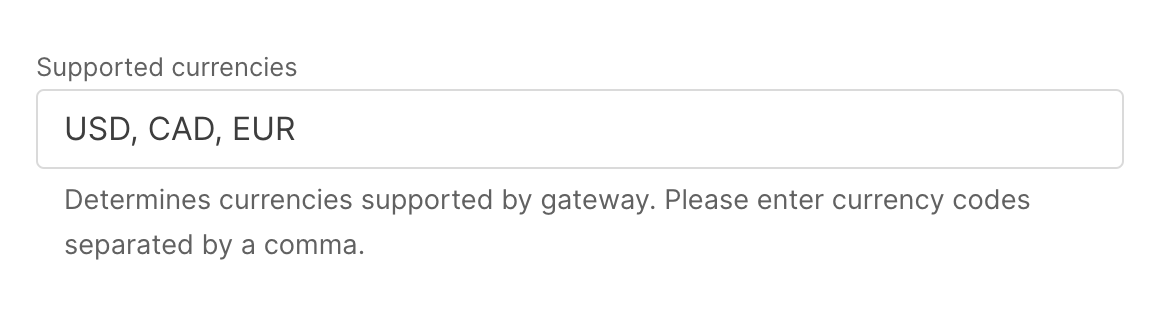

Ensure that your payment gateway is configured to accept the currencies you support. For example, when using Stripe, edit the Supported currencies field in your app settings in Nautical.

To update your app settings, go to Settings -> App Marketplace.

Storefront currency switcher

Even after enabling multiple currencies on a domain, you need to make sure that your buyers have a way to toggle between currencies.

The developer storefront comes with this functionality out of the box, you simply need to update the currencyList setting in your marketplace configuration file.

When correctly configured, see how the product price changes in the reference storefront based on the selected currency:

Onboarding multi-currency sellers

You can allow sellers to list products and receive payouts in their local currency.

When your platform supports sellers in multiple currencies, there are two configurations you should be aware of:

- Seller currency: The default currency with which product prices added by the seller are listed.

- Payout currencies: The currency supported by Stripe Connect when onboarding new sellers.

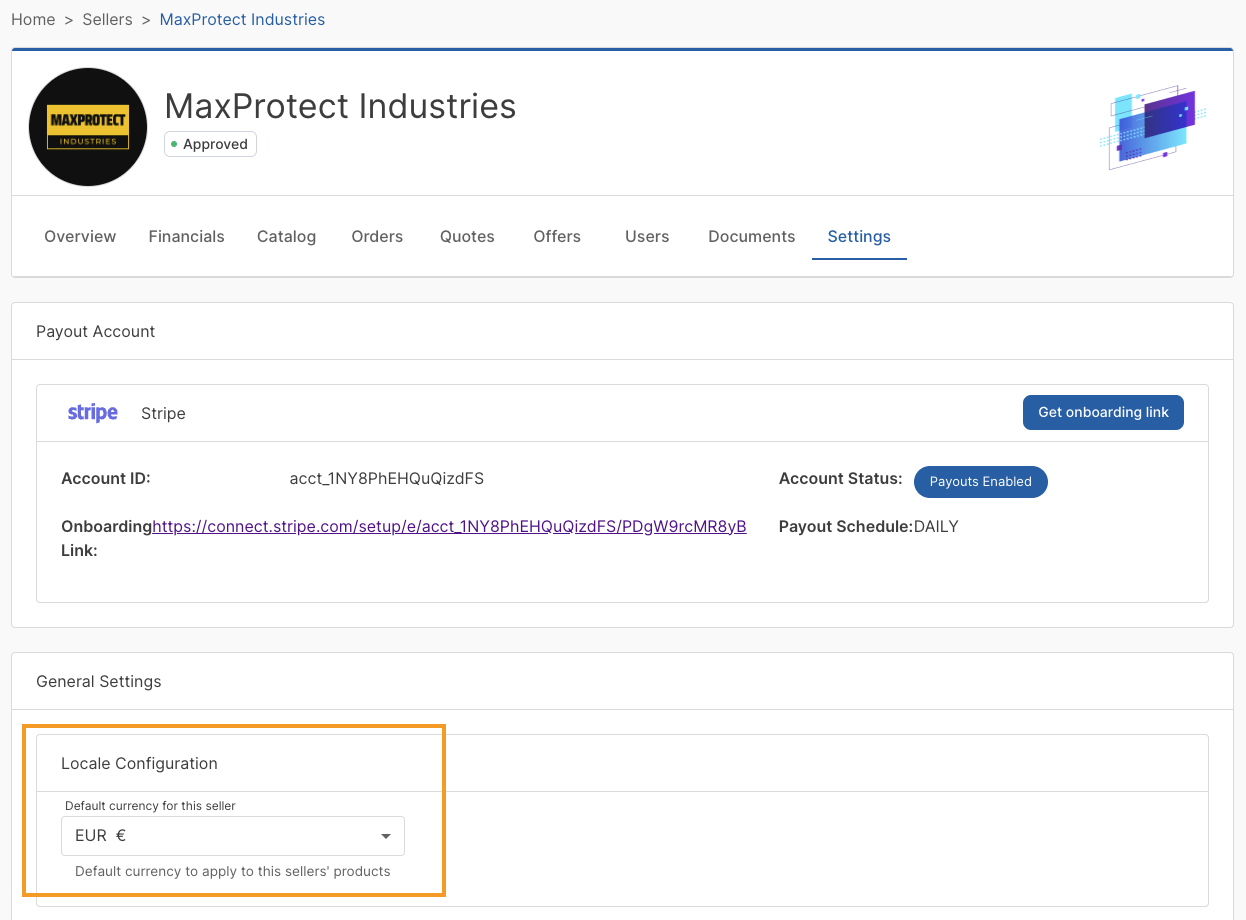

Assign seller currency

Each seller can choose their local currency from the Settings tab of their seller account. When the seller adds products or variants, their currency is selected by default when they are adding product prices.

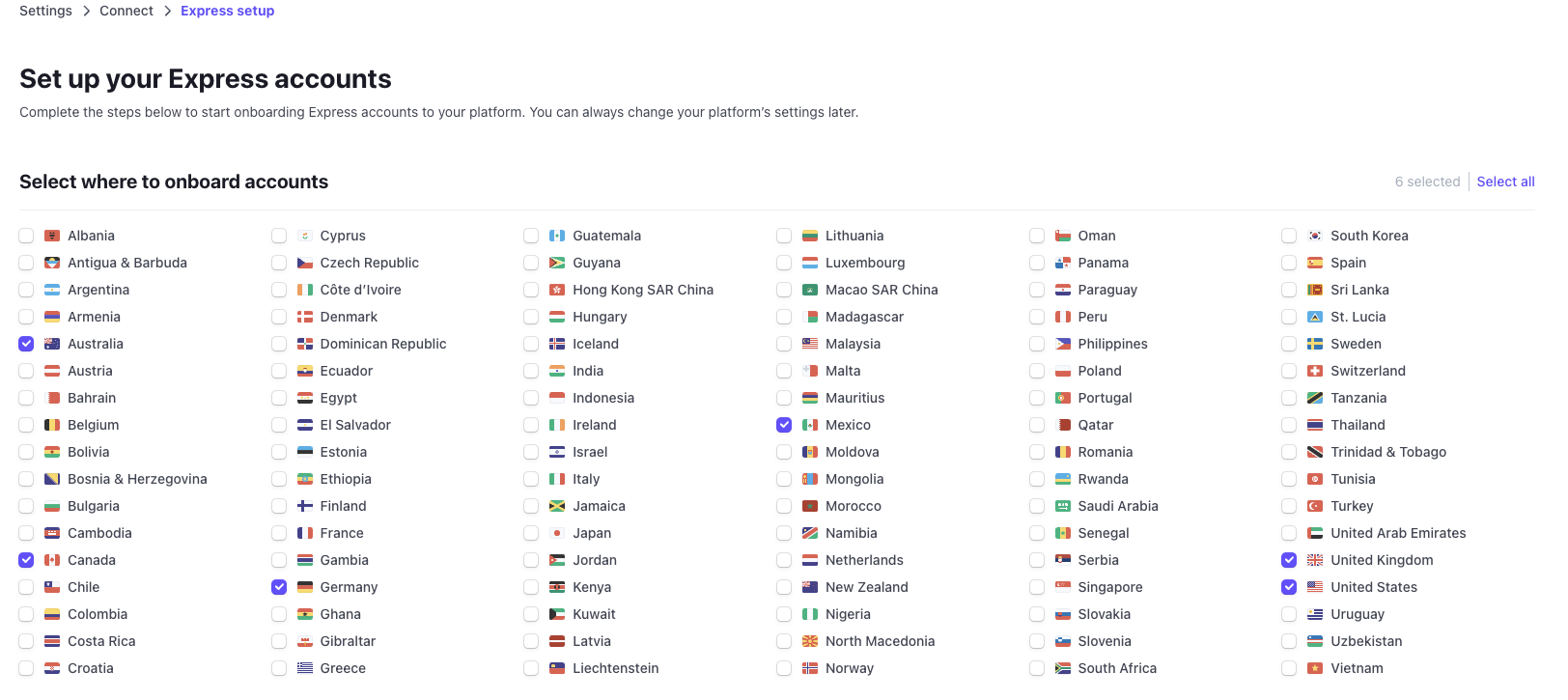

Configure payout currencies

As part of setting up payouts with your payout gateway, such as Stripe Connect, you need to choose which countries you will allow sellers to onboard from.

With Stripe Connect, once you select the countries you want to support, the seller onboarding form will allow sellers to choose their local currency and add a bank account from their country. Payouts will be converted to their local currency before being deposited.

Frequently asked questions (FAQ)

See answers to the following frequently asked questions.

How can I configure the domiciled currency?

When enabling multi-currency in your environment, a Nautical Commerce representative will work with you to configure your domiciled currency.

How can you specify where products can be sold?

That depends on a few factors:

- The shipping zones associated with product inventory in a given warehouse determines where a product can be purchased and shipped to.

- The currencies on your storefront determine which currencies products can be purchased in.

- The sellers added to each domain determine which sellers' products can be purchased on each domain.

What currency do products appear to the buyer in?

The buyer sees the converted price based on their detected locale or selected currency. The price is converted from the source price as listed by the seller in their selected currency.

How often are exchange rates refreshed?

Exchange rates are automatically fetched from Open Exchange Rates once per day. You can also manually trigger a refresh at any time.

How are payouts and commissions calculated?

Payouts and commissions are calculated and transferred using the marketplace operator's domiciled currency. The transfer is converted to the seller's currency before it reaches their bank account.

How do taxes work?

Taxes are collected in the buyers transaction currency. The marketplace operator must reconcile the multi-currency transactions when paying taxes.

What currency are refunds processed in?

The buyer must always receive their entire nominal refund in their transaction currency. As such, the marketplace operator takes the risk on currency conversion when refunding to a buyer.